Debunking the Myth of Small Business Job Creation

In 1979, MIT researcher David Birch published a report that would, unlike most studies in the field of economics, become big news. Examining more than 5 million individual firm employment records provided by the corporate information-giant Dun & Bradstreet, Birch purported to show that between 1969 and 1976, more than 80 percent of jobs were created by businesses with fewer than 100 employees.

No longer could economists and policymakers simply assume that large corporations were the big job generators. Now a host of small business preferences, from tax breaks to regulatory exemptions to procurement favors, could be justified, not by the old-fashioned argument that small proprietors are the pillars of a democratic society but because small businesses are the most important job generators, the backbone of the economy.

Despite Birch later admitting that his results were a “silly number” that he could change “at will by changing the starting point or the interval,” his claim has been endlessly repeated, like an urban myth, getting larger and larger, and even being garbled into claims that small business is responsible for all job creation. Years later, the sentiment is still being hammered into the American psyche by small-is-beautiful advocates and presidents on both sides of the aisle.

The problem, of course, is that Birch’s findings simply don’t hold up. To be sure, some economists have come to similar conclusions, but many others have criticized them, finding significantly different results. Still others have added the wrinkle that it is not small firms that are the big job generators but new businesses.

In attempting to replicate Birch’s work, the economist Catherine Armington found that from 1976 to 1982, small firms were responsible for 56 percent of new jobs, a far cry from over 80 percent and much closer to their actual share of total jobs. Other studies found less compelling or even contradictory results. A study in 2010 found that large firms more than a decade old with more than 500 workers employed 45 percent of private-sector workers and accounted for 40 percent of job creation. And a study by American Express and Dun & Bradstreet found that mid-market firms — that is, companies larger than small businesses but smaller than big businesses — with revenues between $10 million and $1 billion were responsible for 92 percent of the net new job creation from 2008 to the end of 2014.

Only favoring firms when they are small is as perverse and unhealthy as the attitude of parents who hope that their children will never grow up.

Other recent research has drilled down and found that it is not small firms per se that create most jobs, only new ones. The authors of the 2010 study found that after controlling for firms’ age, “the negative relationship between firm size and net growth disappears and may even reverse sign as a result of relatively high rates of exit amongst the smallest firms.” In other words, it is not the size of the firm that matters in job creation, it is the age. Just as young children grow faster than adults, young firms grow faster than mature ones.

Nevertheless, a widely cited study for the Kauffman Foundation, a foundation devoted to supporting entrepreneurship, found that all net job growth comes from firms less than one year old — that is, startups. The problem is that these new firms also destroy jobs, as many go out of business soon after they start. “The obvious pattern, and one that has been largely ignored in previous studies,” writes Jonathan Leonard, an economist at Berkeley whose research focuses on labor market regulation, job turnover and incentives, “is that small establishments account for most net job loss just as surely as they account for most net job gain.” That’s to say that lots of new firms hire workers, but most proceed to lay them off when they go out of business. This is why the U.S. Census Bureau asserts that the median net employment growth for young firms is “about zero” — an observation perhaps best illustrated by the Small Business Administration (SBA), who found that just one-third of new businesses survive to their tenth year.

According to the logic of small business advocates, society should favor firms when they are small, but as soon as they add their 501st employee, they become the object of indifference or even derision. This is as perverse and unhealthy as the attitude of parents who hope that their children will never grow up.

Perhaps the biggest indictment of the small-is-beautiful view when it comes to jobs is the simple fact that in the United States small firms’ share of output and employment over time have been declining for decades. Far from becoming more important to the U.S. economy, small firms are becoming less important, at least when it comes to job creation. In fact, from 2000 to 2014, the share of employment in firms with fewer than 500 employees actually fell, from 53 percent to 51 percent. Moreover, the Bureau of Labor Statistics reports that “since its employment low in October 2009, employment in firms with less than 50 workers grew at an annualized rate of 0.8 percent through March 2011. In comparison, employment in large firms grew at an annualized rate of 2.1 percent after reaching a low point in February 2010.” And according to the 2011 U.S. Census Bureau’s Statistics of U.S. Businesses, firms with zero to four employees accounted for only 5.2 percent of all employment. In contrast, firms with more than 500 employees accounted for 51.5 percent of all employment, most of it coming from the very largest of them: those with more than 10,000 employees. This is hardly evidence of the increased importance of small firms.

Far from becoming more important to the U.S. economy, small firms are becoming less important, at least when it comes to job creation.

Finally, research shows that employment change in large firms is a larger driver of the unemployment rate than employment change in small firms. When firms with over 1,000 workers add more workers than firms with workers with fewer than fifty workers, the economists Giuseppe Moscarini and Fabien Postel-Vinay found, the unemployment rate goes down. And the converse is true as well. This is why research shows that while small firms create more jobs during periods of high unemployment, they create fewer during periods of full employment. And it is why, Moscarini and Postel-Vinay write, “The conventional wisdom that ‘small businesses are the engine of job creation’ finds some empirical support in our data only at times of high unemployment. … This statement clearly fails in tight labor markets.” In fact, one reason why small firms grow more in recessions is that they benefit from high unemployment, as that relaxes hiring constraints. In other words, workers who otherwise would want to work at large corporations that pay more and have better benefits now have no other choice but to work at small firms.

But what about startups, the supposed source of American economic renewal? It turns out that most startups don’t actually create that many jobs either. As Scott Shane, an entrepreneurship expert and author of “The Illusions of Entrepreneurship,” writes in his book, “Only 1 percent of people work in companies less than two years old, while 60 percent work in companies more than ten years old.”

The majority of small companies actually shed jobs after their first year. One study found that among small companies in their second, third, fourth, and fifth years of business, more jobs were lost to bankruptcy than were added by those still operating. This is why the mean number of workers per firm actually goes down every year after a firm is born. According to the SBA, the mean number of workers in a new firm in its first year is 3.07. But by year five this figure declines to 2.36, and to 1.94 in year 11. Or, as the SBA puts it, “Employment gains from growing businesses are less than employment declines from shrinking and closing businesses.”

During the depths of the 2008–2009 recession, small businesses were adding an average of nearly 800,000 new jobs a month. But they were losing an even larger number of jobs per month — about 971,000. In short, small firms create lots of jobs, but they also destroy lots of jobs. In light of increased concern about employment instability, this certainly can’t be a good thing, at least for the workers, half of whom lose their jobs.

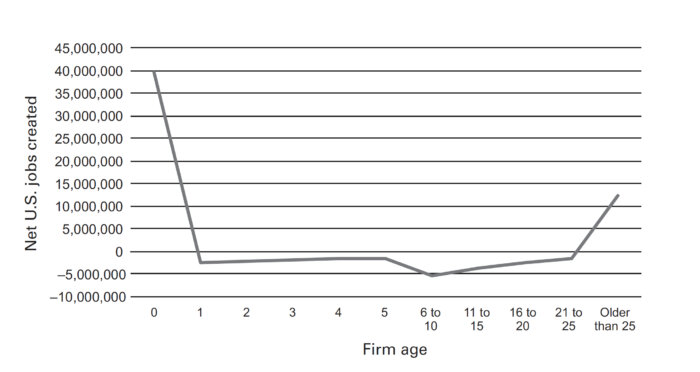

Statistics that claim to show that small businesses are responsible for the lion’s share of job creation frequently rely on data in the graph above. New firms by definition cannot lose employees from the previous year, and any employees on the payroll are credited as “jobs created.” By contrast, if a firm in its second year goes out of business, this is counted as negative job growth. From 2000 to 2013, only very young and very old firms showed positive net job growth.

The fact that young and adolescent companies don’t on net create many jobs cannot be blamed on regulation and high taxes; if anything, small business is pampered and protected when it comes to the taxes and regulatory burdens bigger firms face. Rather, most small business owners have no desire to grow their firms. Nearly three-quarters of individuals who start a business want to keep their businesses small. Surveys show that the lion’s share of people who start businesses do so not because they want to be a rich entrepreneur, something that takes enormous dedication and hard work to achieve; rather, most don’t want to work for a boss. As Scott Shane found, “One study of a representative sample of the founders of new businesses started in 1998 showed that 81 percent of them had no desire to grow their new businesses.”

Nearly three-quarters of individuals who start a business want to keep their businesses small.

Another study found that 50 percent of small business owners did not start their business principally to make money. Indeed, a Federal Reserve Bank study by the economists Pugsley and Hurst noted that when asked about their ideal firm size, the median response of new business owners is that they desire their business to only have at most a few employees. This is not surprising given that the overwhelming majority of small business owners in the U.S. are skilled craftspersons (e.g., plumbers, electricians, painters), professionals (e.g., lawyers, dentists, accountants, insurance agents), or small shopkeepers (e.g., dry cleaners, gas stations, restaurants).

This, combined with the fact that so many new firms fail within ten years, is why Shane has found that it takes 43 startups to end up with just one company that employs anyone other than the founder after ten years. And on average, that surviving startup will have just nine employees. Why, then, should policies favor small and new business in order to create jobs? To replace the small-is-beautiful consensus with an equally simpleminded big-is-beautiful orthodoxy would be imprudent. On the contrary, in a modern capitalist economy, businesses of every size, along with government agencies, research universities, and other nonprofit organizations, play essential roles.

As the distinguished engineer and author Samuel Florman wrote, “Smallness, after all, is a word that is neutral — technologically, politically, socially, aesthetically, and, of course, morally. Its use as a symbol of goodness would be one more entertaining example of human folly were it not for the disturbing consequences of the arguments advanced in its cause.” Indeed. Small enterprises have an important place in the American system. But to flourish in the 21st century, we must learn again that big can be beautiful, too.

Robert D. Atkinson is the founder and president of the Information Technology and Innovation Foundation, in Washington, D.C. He is co-author (with Michael Lind) of “Big Is Beautiful: Debunking the Myth of Small Business” and author of “Innovation Economics: The Race for Global Advantage.”

Michael Lind is co-founder of the New America Foundation, a non-partisan think tank, and author of “Land of Promise: An Economic History of the United States.”